How to Get Your FICO Credit Score for Free

Your credit score can shape the future of your finances, even more so than your age or income. No single factor matters more to potential lenders, and those with poor scores can wind up shelling out hundreds more in interest payments over time. But despite the crucial nature of this three-digit number, many Americans are unsure of their score and how to obtain it.

Considering the complexity of credit reporting today, we can’t say we blame those confused about credit scores.

There are dozens of credit scores for certain kinds of loans, and each utilizes slightly different data and criteria. To make matters worse, the three major credit reporting agencies – Experian, Equifax, and TransUnion – were recently fined millions for intentionally misleading customers by telling them their scores were identical to those used by lenders.

For millennials beginning their lifelong credit journeys, uncertainty is especially common. According to a recent survey, only 42% of millennials said their credit score knowledge was “good” or “excellent.” Just 51% had ever checked their credit score for free.

If you’re a part of the crowd that would like to know more about where your score stands, your best bet is checking your FICO credit score. While it’s not the only scoring algorithm out there, it is the credit score provider most lenders use to make decisions about loaning you money. According to the company, 9 in 10 top lenders use one of FICO’s scores, and their scoring has been around since 1989.

There’s a catch, though: FICO will charge you for seeing your score, with reports starting at about $20. Thankfully, consumers can increasingly see their FICO scores for free by utilizing a few resources. This guide is intended to help you do just that by laying out your options. Read on to see how you can see your score without paying for the privilege.

Reports, scores, and more: Understanding your options

You may already have a free FICO score solution in mind: You can get one for free every year, right? Unfortunately, that’s not the case.

Here’s where that common misconception comes from: Under the Fair Credit Reporting Act, you are entitled to one free credit report every year from each of the three major credit reporting agencies. You can get a free report by heading over to annualcreditreport.com.

These documents contain the information that each of these agencies provides to FICO, and FICO, in turn, uses these data to formulate your score. You’ll see your full credit track record from the last seven years, including your payment history, total debt, and more. But you’ll notice one glaring absence: You won’t find your FICO credit score anywhere on those documents. Technically, the company has nothing to do with this process, which is between the credit reporting agencies and the federal government. You can buy a credit score from these agencies, but it will leverage their algorithms, not FICO’s.

Credit Term Glossary

What they are

Who creates them

Credit reports

Full documentation of your borrowing and payment activity, dating back 7 years (or 10 with some types of bankruptcies). You can one free from each major credit reporting agency every year.

The three major credit reporting agencies: Experian, Equifax, and TransUnion.

Credit scores

Single metrics produced by running information from your credit report through a company's proprietary algorithm. Most lenders use credit scores as a shortcut for assessing potential borrowers.

While many companies offer "educational" scores meant to approximate what lenders will use, the Fair Isaac Corporation creates the FICO credit scores used by most lenders.

As if this distinction isn’t frustrating enough, many sites offer free credit scores that don’t use the FICO formula. They’re intended as “educational” metrics for consumers’ benefit, and while they’re pretty close approximations of your FICO score, there’s no guarantee they’re close to what lenders will see.

If the chances of getting your FICO score for free seem pretty bleak at this point, think again. Thankfully, a growing number of institutions offer Americans opportunities to see their FICO scores free of charge.

Ways to get your FICO score for free

The recent availability of free access to scores has a lot to do with FICO’s Open Access program, which allows businesses to share the FICO score they’re using with their customers at no additional cost. When financial institutions learned they could offer this additional value, credit scores started showing up in customers’ apps and monthly statements. In the program’s first two years, FICO says more than 100 million consumers got free access to their credit scores.

If you want to know if you’re one of them or are eager to see your FICO score for free by other means, here’s a definitive list of no-cost ways to see your score:

Where to go for your free FICO score:

- Your bank

- Your credit card company

- A credit counseling agency

- Your auto loan lender

Check with your bank or credit card company

Under the aforementioned program, many banks and credit card companies employ free credit scores as an incentive to draw in new customers. But they’re available to current cardholders and depositors as well. Depending on your institution’s particular program, you may see your score included automatically on statements, available online, or even handily accessible on your phone.

Some of the country’s largest consumer banks and commercial lenders offer free credit scores to current customers, such as Bank of America, Chase, Citi, and Wells Fargo. If you have a debit, savings, or credit card account with them, you should have no problem accessing your score.

If your bank or credit card company is among those that don’t offer free scores, Discover offers a free FICO score to anyone – even if you’re not a customer. You can check back every 30 days to get an updated score as well. The company also promises they won’t sell your information to anyone else, though they may email you offers every once in awhile.

Get credit counseling

If you’re already concerned about your debt or credit circumstances, credit counseling can be a valuable – and free – resource. Counseling – which is typically offered by nonprofit agencies – can help you assess your current credit situation and develop strategies for improvement. One particular perk is the guarantee of a free credit score if you work with a counselor, and it should help inform your discussion.

Just be wary of any counseling organization that aggressively demands money, because there are some bad apples out there posing as legitimate resources. The National Foundation for Credit Counseling can connect you to a reputable, trained professional.

Other options

If these two routes to your free score don’t sound like they’ll work for you, there are some alternatives worth mentioning.

Experian offers a free FICO score service, available at freecreditscore.com. A word to the wise: The site is intended to attract potential customers, then attempt to upsell them on other services, such as identity theft monitoring or ongoing credit reporting. That’s not the worst thing in the world, but you risk inundation with unsolicited offers.

Another possibility comes from a surprising source: Auto loan companies are also offering FICO scores to select customers. Ally Financial, Hyundai, and Kia each rolled out programs of this kind for their auto loan borrowers in 2015.

What to do if you don't like what you see

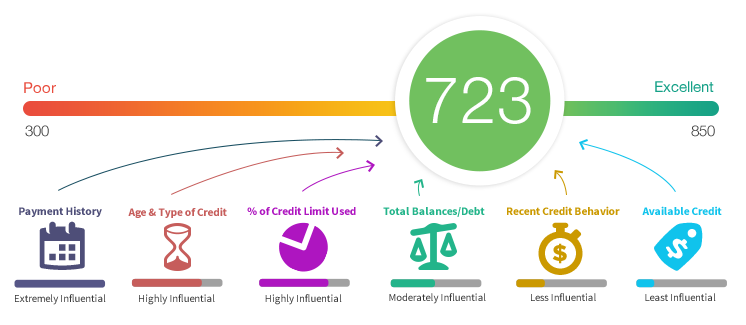

If you successfully obtain your FICO score using one of the options above, you may not be thrilled about the number you see. That’s fine – now that you know your score, you can start taking steps to improve it.

Our Best Ways To Build Credit guide offers comprehensive solutions for steadily increasing your score. We’ve provided a cheat sheet of top tips below, so you know what to do if your score is too low for your comfort.

Quick tips for improving your credit score:

1. Never miss payments

- A single missed payment could stain your credit report for seven years. Be sure to send at least the minimum payment by your due date.

2. Lower credit utilization

- Credit utilization refers to how your debt balance compares to the total you can possibly borrow. As a general rule, avoid using more than 30 percent of your total credit limit.

3. Get a secured credit card

- With a secured credit card, your borrowing can’t exceed a cash deposit you give your lender. Your lender risks nothing, and you use the card to demonstrate responsible payment activity.

4. Take on a credit builder loan

- Unlike with other loans, your lender keeps the money you borrow saved away. Once you pay off the loan, you get the total back in cash. You’re basically saving and building credit all at once.

5. Look into cosigned credit

- If someone with better credit cosigns with you, evidence of responsible repayment on the account will benefit you both. If you can’t get a loan alone, this is one way to prove yourself.

6. Become an authorized user

- As an authorized user, you’re added to someone else’s current line of credit. As payments are consistently made on the shared account, you get credit for that responsible activity.

After the score

In the world of personal finance, knowledge is power. Having your FICO score in hand will equip you to make sound decisions about building better credit or even negotiate with lenders for the terms you deserve. All that upside is made sweeter by accessing your score for free.

For all the next steps that follow obtaining your score, Comet can help. We supply comprehensive resources on a range of personal finance topics, including credit, spending, saving, and more. Visit us often to see new tips and information to help you stay smart about your money.