2 Student Loan Forgiveness Options Just for Pennsylvania Residents

If you’re one of the 44 million Americans with student loan debt, you probably dream of getting help repaying your loans. But, did you know that where you live and what kind of work you do could entitle you to loan forgiveness? It may sound too good to be true, but there are legitimate repayment assistance programs out there that can make your debt more manageable.

If you live in Pennsylvania, you may be eligible for one of its two state student loan forgiveness programs. There's one for healthcare professional and once for attorneys.

1. Repayment assistance for healthcare professionals

If you work in healthcare, you could be eligible for the Pennsylvania Primary Health Care Loan Repayment Program (LRP). The Pennsylvania Department of Health offers this program to recruit and retain primary care practitioners in the state.

How the program works

To qualify for the LRP, you must be willing to work for at least two years at an approved outpatient primary care facility.

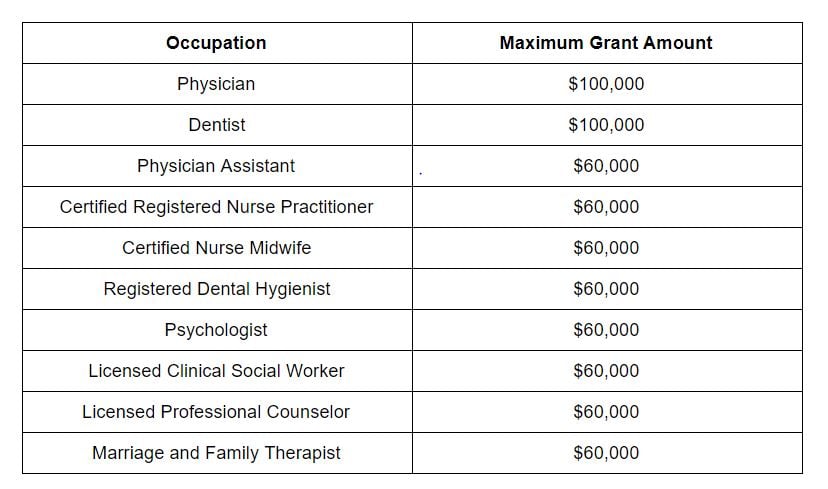

The awards are made based on availability of funding, so there’s no guarantee you’ll receive the full amount. The maximum grant awards vary based on your occupation:

The facility you work for must be in an underserved area or serve low-income populations as designated by the LRP. You can view a list of LRP-approved sites on the Department of Health website.

Which loans are eligible

Both federal and private student loans are eligible for the LRP. If you refinanced or consolidated your loans, you may still be eligible if each of your loans would have qualified before you refinanced.

Loans that you cosigned for someone else or took out for a child are not eligible.

Other forms of related education debt, such as personal loans or credit card debt, do not qualify for the LRP grant.

How to apply

To apply, you must gather the following documentation:

-

Loan account statement detailing the name of the borrower, the remaining balance, and the current interest rate.

-

Disbursement report detailing the name of borrow, type of loan, loan origination date, and loan amount.

Once you have that information together, you can complete the LRP application online. Note: Funds are only disbursed once per year. The application window for 2018 was January 18 through February 21. To apply for 2019, set a calendar reminder to check back in early January.

2. Repayment assistance for lawyers

According to Above the Law, the average law school graduate walks away with $112,776 in student loans. With such a high debt load, it can be difficult to focus on other goals, like saving for retirement or buying a home.

Luckily, Pennsylvania offers some law school graduates relief. To encourage lawyers to work in public service, the state gives borrowers loans which they can use to repay a portion of their debt. The amount of assistance you can receive is dependent on program funding and the number of attorneys that apply that year.

How the program works

To qualify for the program, you must be licensed to practice law in Pennsylvania and practice as an employee of an Interest on Lawyers’ Trust Accounts (IOLTA)-funded organization. IOLTA-funded organizations typically serve low-income communities in which residents traditionally have difficult finding legal aid.

To qualify, your salary cannot exceed $66,000. However, if your annual student loan debt payments are equal to or greater than 10% of your annual income, you may still be eligible regardless of your income.

The repayment assistance program issues 12-month loans, which you use to pay off your student loans. If you complete the service term, the loans are forgiven and don’t need to be repaid.

Which loans are eligible

Federal and private loans are eligible for repayment assistance. Other forms of debt, such as personal loans, do not qualify. You can receive up to ten years of repayment assistance.

How to apply

To apply, you must create an account with WebGrants. Once you have an account, you’ll be able to fill out the application online. The site will prompt you to enter your personal information, including your name, address, student loan debt amount, and employer details.

Note: Loan assistance is administered once a year. The application window for 2018 was September 18 through mid-October. To apply for 2019, set a calendar reminder to check back in early September of 2019.

What to do if you don’t qualify for loan forgiveness

If you don’t qualify for one of the Pennsylvania repayment assistance programs, don’t give up hope. There are three other ways to make your debt more manageable.

1. Research federal programs and grants

There are federal programs and grants available that might discharge some or all of your current student loans. For example, if you work for a non-profit organization or a government agency, you could qualify for Public Service Loan Forgiveness.

To find other programs that might be relevant for your career, check out our Ultimate List of Grants to Pay Off Your Student Loans.

2. Sign up for an income-driven repayment plan

If you have federal loans, you may be eligible for an income-driven repayment (IDR) plan. Under an IDR plan, your loan servicer extends your repayment term and caps your payment at a percentage of your discretionary income. Some borrowers will apply for a payment as low as $0.

See also: How to Enroll in Income-Driven Repayment for Your Student Loans

3. Refinance your loans

If you need to lower your monthly payment or if you want to reduce your interest rate, consider refinancing your student loans. With refinancing, you work with a private lender to take out a new loan for the amount of your old ones. The new loan has different terms, such as interest rate and minimum monthly payment. Many people who refinance are able to lower their payments by up to $250 a month.

If you're interested in investigating refinancing, a good first step is to get a quote online and find out how much you can save.

Refinance & Save Today With These Leading Lenders

View More Details

View More Details

Special offers for medical resident and fellow refinance products

- Fixed rates: 4.39% - 9.24% APR

- Variable rates: 2.50% - 9.24% APR

- Minimum credit: 650

Splash Financial is a leader in student loan refinancing with some of the lowest fixed in the industry which can save you tens of thousands of dollars over the life of your loans. No application or origination fees and no prepayment penalties. Splash Financial is in all 50 states and is intensely focused on customer service. Splash Financial is also one of the few companies that offers a great medical resident and fellow refinance product. You can check your rate with Splash in just minutes.

- Low interest rates – especially for graduate students

- No application or origination fees. No prepayment penalties.

- Co-signer release program - you can apply for a cosigner release form your loan after 12 months of on-time payments

- Specialty product for doctors in training with low monthly payment

Click here to see more of Splash's offerings and to see how you can save money.

View More Details

View More Details

SoFi is the leading student loan refinancing provider.

- Fixed rates: 3.99% - 8.24% APR

- Variable rates: 2.49% - 7.99% APR

- Minimum credit: 650

$30 billion+ in refinanced student loans. SoFi has some of the lowest interest rates and, unlike the other lenders we reviewed, there's no maximum on the amount you can finance. Some state restrictions may apply.

- Serious savings: Save thousands of dollars thanks to flexible terms and low fixed or variable rates.

- No hidden fees, no catch: No application or origination fees. No pre-payment penalties.

- Fast, easy, and all online: Simple online application and access to live customer support 7 days a week.

- Access to member benefits: SoFi members get career coaching, financial advice, and more—all at no cost.

- 98% of surveyed members would recommend SoFi to a friend

Save thousands on your student loans and pay off your loans sooner. Find your rate.

View More Details

View More Details

Works with 300+ community lenders for higher approval chances

- Fixed rates: 2.49% - 7.75% APR

- Variable rates: 1.90% - 5.25% APR

- Minimum credit: 660

Connecting student borrowers to a network of over 300 community lenders with low interest rates. By partnering with these lenders, LendKey is able to give consumers direct access to the best rates available from the most borrower friendly institutions. As the servicer of all loans obtained through its platform, you can rest easy knowing your personal information will be safe and that the best customer service team will be ready to answer your questions from application until your final payment.

- Lightning fast rate check - 2-minute rate check with no impact on your credit score

- More lenders, more options - see the best offers from over 300+ community lenders for higher approval chances

- Life of loan relationship - With LendKey, your personal information will never be sent or passed on to third parties. Their customer service team is with you from the moment you land on their website until you've completely repaid your loan.

- Unmatched benefits- Community lenders put people over profits and offer unique benefits like cosigner release after 12 on-time payments, interest only repayment options to keep monthly payments low, the largest unemployment protection period in the market, and more.

View More Details

View More Details

Best for borrowers who want to customize their repayment schedule to pay off debt fast.

- Fixed rates: 4.39% - 8.99% APR (with 0.25% autopay discount)

- Variable rates: 3.99% - 8.29% APR (with 0.25% autopay discount)

- Minimum credit: 650

Using technology, data, and design to build affordable products, Earnest's lending products are built for a new generation seeking to reach life's milestones. The company understands every applicant's unique financial story to offer the lowest possible rates and radically flexible loan options for living life.

- Commitment-free 2 minute rate check

- Client Happiness can be reached via in app messaging, email, and phone

- No fees for origination, prepayment, or loan disbursement

- Flexible terms let you pick your exact monthly payment or switch between fixed and variable rates

- Skip a payment and make it up later

- Online dashboard is designed to make it easy to apply for and manage your loan

Click here to apply with Earnest and to see how much you can save.