How to Pay Off Your Med School Debt Faster

If you just graduated medical school and are already stressing out over your loans, you’re not alone. Approximately 83% of newly-minted doctors graduate with more than $100,000 in debt. A lot more. The average graduate carries about $192,000 in student loans.

If you’re carrying that level of debt, you might assume you’ll be paying it off well into retirement. But, believe it or not, it doesn't have to be that way. Here are a few ways doctors get rid of their student loans fast—sometimes in as little as a few years.

Pay extra every month

All through medical school and then as a resident, you probably lived off Ramen and shared a three-bedroom apartment with five roommates. Now that you’re making a full physician’s salary, it might be tempting to ditch the frugal habits.

Not so fast.

You already know how to live inexpensively. If you can tough it out for just a few more years and put all your excess money toward paying off your loan, you can make a serious dent in your debt.

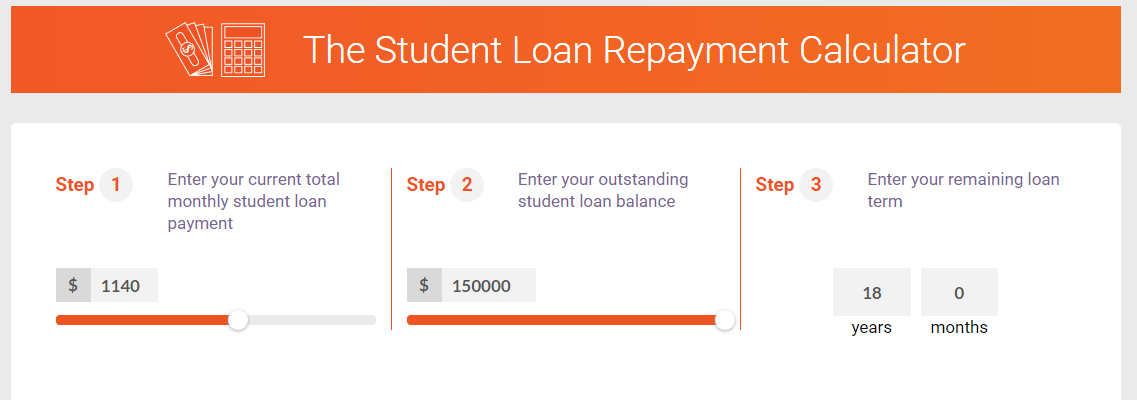

How serious? Use our Student Loan Payoff Calculator to find out how much faster you can get out of debt by paying ahead every month.

Say you had a $150,000 loan balance at about 6% interest. Making your minimum payment every month, you'd take about 18 years to wipe out the debt.

But look how much you'd be paying in interest ... close to $100,000. Ouch.

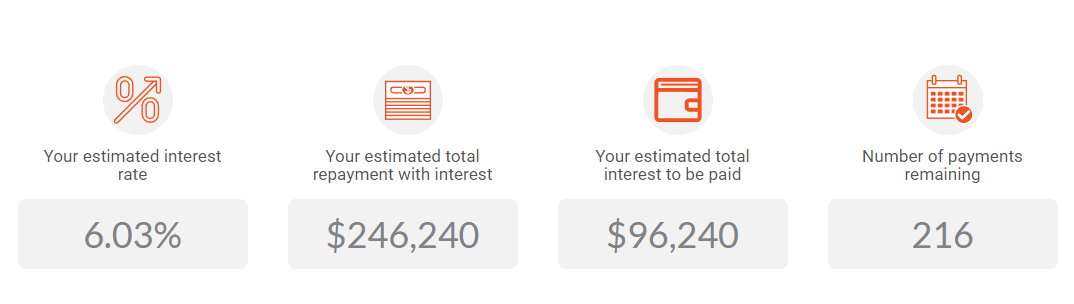

But if you could pay an extra $100 every month, you could shave 29 months off your loan and save close to $15,000 in interest.

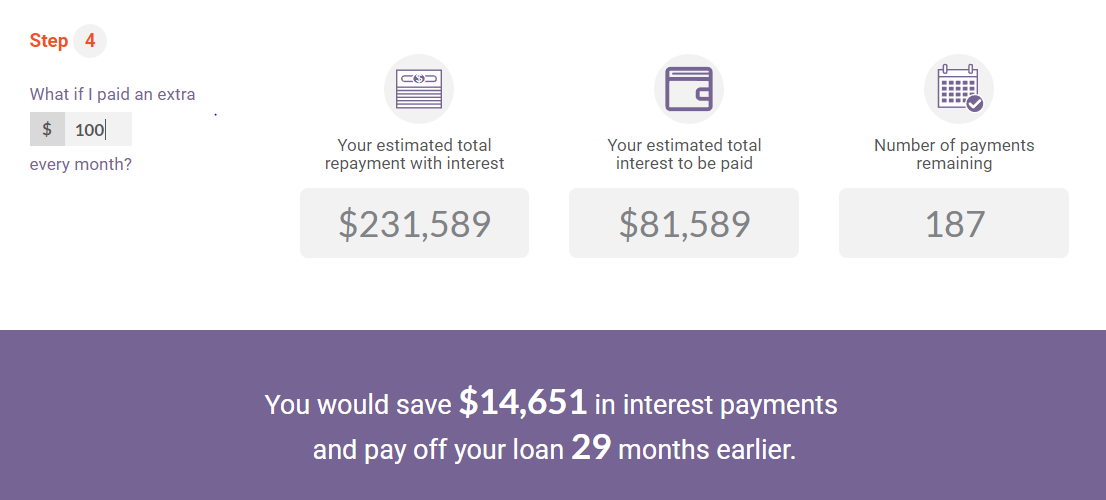

Look at the savings if you could pay an extra $1,000 per month.

Put your signing bonus toward your loan

A lot of healthcare facilities pay a signing bonus, sometimes as much as $20,000, to attract new physicians. If you get one, put it directly toward your student loans.

If you put such a large chunk towards your loans at once, you could knock off as much as a year’s worth of loan payments at one time.

See also: Who Has More Student Loan Debt: Doctors or Lawyers?

Get your loan forgiven in less than a decade

The big name in student loan forgiveness is the Public Service Loan Forgiveness (PSLF) program.

Under this program, you can get your federal loans forgiven after 120 qualifying payments, as long as you’re working for an employer that qualifies. This takes most people about 10 years. But there are programs that will forgive your loans in a shorter time period.

For instance, the National Health Service Corps offers up to $50,000 for your student loans if you commit to a two-year period of working in a medically underserved area. If you stay longer, you can get even more toward your student loans.

If you’re still in school as a doctor or dentist, you can earn $120,000 toward your loan in your final year of school by committing to work for at least three years in a Health Professional Shortage Area when you graduate.

There are other programs like this on the state level, and it’s worth it to find one that fits in with your goals in terms of the kind of work you want to do and where you want to live.

Learn more about student loan forgiveness for medical professionals.

Refinance your student loans

You can save serious cash by refinancing your med school loans. Here are the federal interest rates for the more common federal loans for med students, taken out for the 2017-2018 academic year:

- GradPLUS loans: 7%

- Unsubsidized Stafford loans: 6%

- Perkins loans: 5%

By contrast, some financial institutions offer a significantly better deal, interest-wise, for those who refinance—sometimes as low as 2.5%. Of course, each lender is different, and the interest rate you’re offered will depend on your credit score and financial situation.

However, as a doctor, you’ve got a high earning potential, which could improve your chances of getting a better interest rate. It’s worth it to see how much you could save.

Keep in mind that If you refinance federal loans, you’ll lose the opportunity to get your student loans forgiven under PSLF. But some forgiveness programs for doctors also forgive private loans, so do your research before taking this step if loan forgiveness is part of your plan.

Medical students carry significant debt—but it doesn’t have to take your whole life to repay it. With one or more of these strategies, you could pay off your loan in years, not decades.

Want to find out how much you could save by refinancing? See if you're Refi Ready.