How to Apply for Public Service Loan Forgiveness in 5 Steps

Think you might qualify to get your federal student loans forgiven under the Public Service Loan Forgiveness (PSLF) program? Here’s a step-by-step on how to qualify—and how to get your loans forgiven.

See also: Is Public Service Loan Forgiveness All it's Cracked Up to Be? 4 Things to Know

1. Get a full-time job with a qualifying employer

PSLF exists to reward people who work in public service, so the determining factor in whether you qualify for PSLF is who your employer is.

Generally, the following types of employers qualify for PSLF:

- Federal, state, local, or tribal government organizations.

- 501(c)(3) nonprofit organizations.

- Non-501(c)(3) nonprofits that provide public services as their primary mission.

You generally have to be employed full-time at a qualifying organization to qualify for PSLF. However, if you’re a volunteer in the Peace Corps or AmeriCorps, you can also qualify.

2. Enroll in a qualifying repayment plan

To qualify for PSLF, you have to be enrolled in one of four income-driven repayment plans. These have a payment term of 20-25 years.

Technically, you can also be enrolled in the Standard Repayment Plan—which is the default plan you get enrolled in when you start to pay off your federal loans.

The issue with that, though, is that the Standard Repayment Plan is a 10-year term. And under PSLF, you have to make 120 payments to get your loans forgiven—which takes about 10 years. That means your loan forgiveness kicks in just as you make your last payment.

Bear in mind, too, that the Standard Repayment Plan for Direct Consolidation Loans is different than the 10-year Standard Repayment Plan—and it doesn’t qualify for PSLF. If you have any doubts about whether you're in the right payment plan to qualify for PSLF, call your lender ASAP.

3. Make 120 qualifying payments

What is a “qualifying payment?” We’re glad you asked. To qualify, your payment must be:

- Made after Oct. 1, 2007.

- Made under an income-driven repayment plan.

- For the total payment amount shown on your bill.

- No later than 15 days after the bill is due.

- While you’re working full-time for a qualifying employer.

You can’t make qualifying payments toward PSLF while:

- Working for a non-qualifying employer

- Your loans are in deferment or forbearance

- Your in school, or

- You’re in a repayment grace period.

See also: Paying Off Student Loans

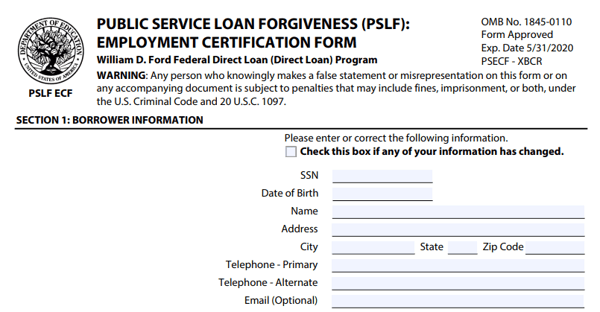

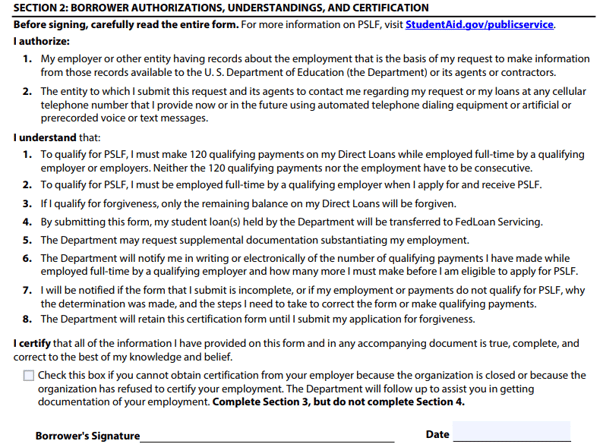

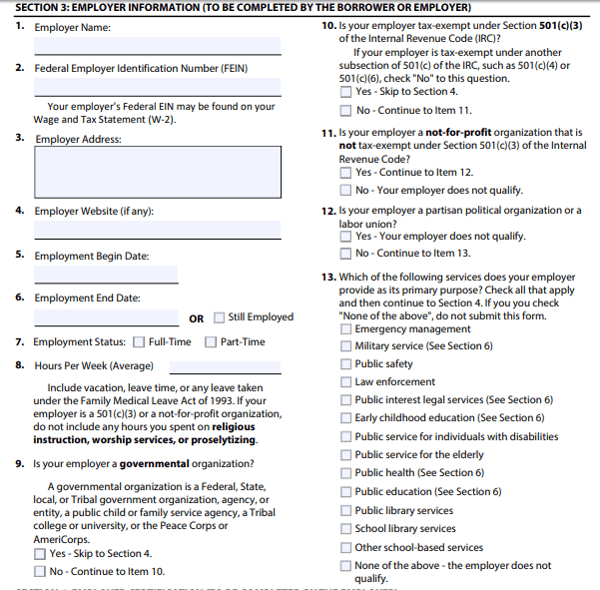

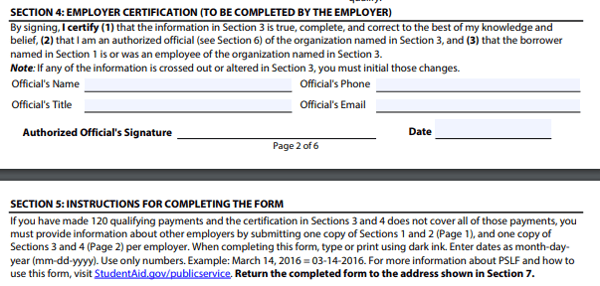

4. Complete the Employment Certification for PSLF Form

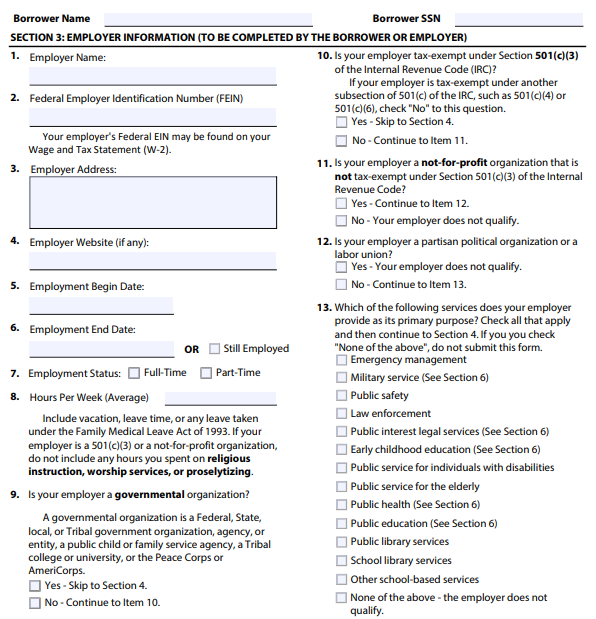

This form needs to be completed and sent in both once a year and whenever you change employers.

This form documents and ensures that you’re working for a qualifying employer while you make payments. If you don’t do this, you could apply for forgiveness in ten years only to find that none of your payments qualified.

Here’s where you get it and here’s what it looks like:

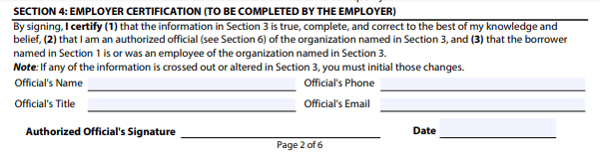

You also have to get your employer to certify this document. Usually the appropriate person is either someone in your Human Resources department, or your direct supervisor. Check with your employer to find out who’s authorized.

Once it’s ready, send the form to this address:

US Department of Education

FedLoan Servicing

PO Box 69184

Harrisburg, PA 17106-9184

Once the government receives your form, it will notify you whether your employer and loans qualify, or whether they need more documentation. They’ll also tell you how many qualifying payments you’ve made and how far you have to go.

5. Submit your PSLF application

Once you’ve made your 120 qualifying payments, your loan won’t automatically be forgiven. To start the process, you’ll have to submit another form after you’ve made your 120th qualifying payment.

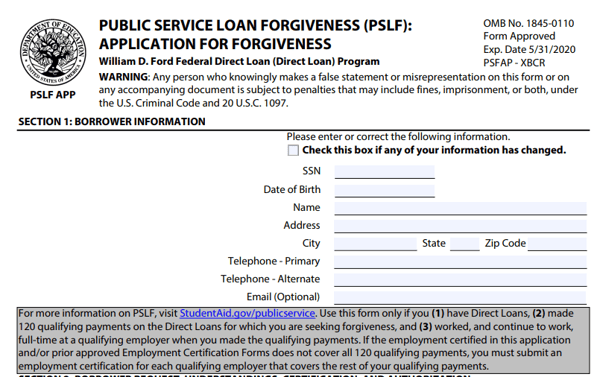

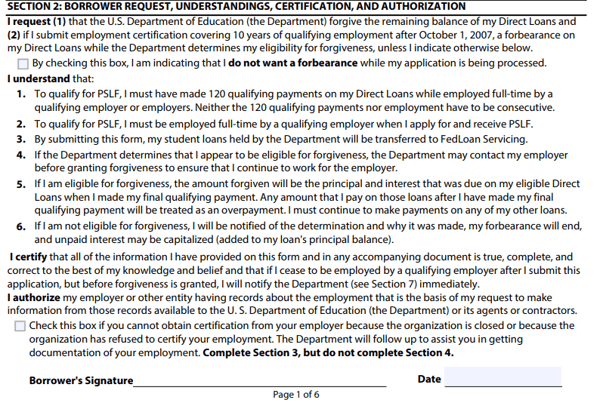

That form is the PSLF application. Here’s where you get it and here’s what it looks like:

To qualify, you have to be working full-time for a qualifying employer—both when you submit the form and when your loan is forgiven. So yes, you'll need to have your employer certify your employment on this form as well.

Getting your student loans forgiven under PSLF is a decade-long odyssey. But it’s possible. Follow these instructions, and hopefully you’ll get your loans forgiven.

Don't qualify for PSLF? Learn about refinancing your student loans to lower your monthly payment or pay off your debt faster.