3 Financial Milestones Most People Reach in Their 20s — Are You on Track?

In the words of talk show host Wendy Williams, “How you doin?”

Before you answer, maybe you should look to your right and your left and see how your “neighbor” is doing to get a different perspective. It’s easy to have a false sense of security when you’re looking in the mirror only at yourself.

The story can change when others come into view. But knowledge is power. Go ahead, check up on your peers.

Comet's survey, The Typical American Financial Life, looked at more than 1,200 people at various ages, and asked them how old they were when they experienced major financial milestones. Those watershed moment include things like earning a strong credit score or buying a home of their own. We averaged their responses to determine the typical American’s financial timeline.

Buying a house

Nothing screams success quite like buying your first home.

It’s official, you’re a grown up. You managed to save up a down payment and to have your credit in good enough shape to qualify for a mortgage.

How old were you when you achieved this goal? Among those polled, the average age to buy a house was 29.

Start saving for retirement

You’ve heard it a million times, but we'll say it again: the sooner you start saving for retirement the better. Time gives your money the maximum ability to compound. In other words, to grow, grow and grow some more.

It’s tough to make saving for retirement a priority when you’re young. Retirement seems so far away and you feel a sense of urgency about plenty of other things, be it a bucket list vacation or paying off student loans, but getting your senior citizen's discount isn't one of them.

Did you start socking sock away money as soon as you got your first real job? According to the survey, the average age to start saving for retirement was 26.

Student loan debt

It's no secret that millennials tend to carry more student loan debt than older generations.

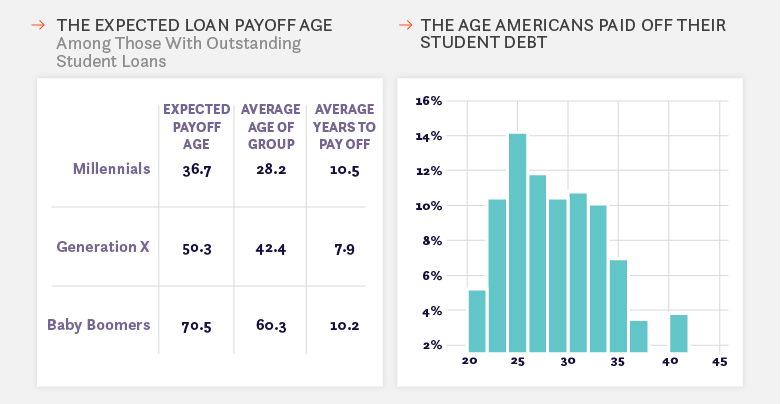

When broken down by age, most millennials expected to pay off their loans by 36(ish). Our chart shows Gen Xers and Baby Boomers paying their loans off much later, but some of that could be attributed to people returning to school or starting school years or decades after high school graduation.

If you're not on track to pay off your student loans in a reasonable amount of time, or you'd like to find ways to pay them off faster, you might want to consider refinancing. Check out our Student Loan Refinancing Calculator to find out how much you could save.